It turns 90 in a few weeks the Tyrolean monetary experiment of “expiring” currency, put into practice by a prophetic Burgomaster. Let’s find out the origins, results, and epilogue

Woergl’s “EXPIRING” Currency

# Woergl and the Burgomaster’s prophecy

1931. Austria. The small municipality of Woergl is dealing with the consequences of the Great Depression. 4500 inhabitants of whom 2000 are working and 1500 unemployed.

Leading the town is a former railwayman and labor unionist, Michael Unterguggenberger, born in 1884, who finds itself in the municipal cashes 32,000 shillings: which at that time was roughly equivalent to $4,500 today. A pittance.

Unterguggenberger himself, at the end of the first Great War, analyzing the condition of Europe warned of a danger: «I dare predict today that it will not be 25 years before another, much more terrible war comes. Uncontrolled revolutionary movements will form among the unsatisfied masses and the poisonous plant of extreme nationalism will flourish». But back to the economic problem: how to deal with a severe depression if municipal funds are empty?

# The expiring currency against unemployment

The burgomaster had to face up two problems brought about by the Great Depression: severe unemployment and the fact that out of prudence, savers kept their shillings hidden in their mattresses or other places, thus preventing them from circulating by fueling the economy.

To solve both problems, the Burgomaster relies on Silvio Gesell’s monetary theory: expiring currency.

It consists of issuing a currency that loses value within a very short time.

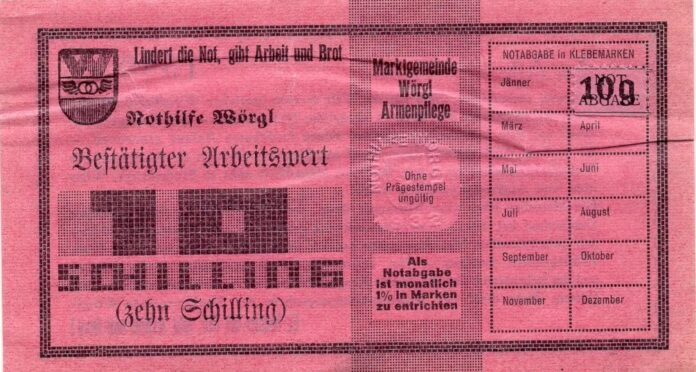

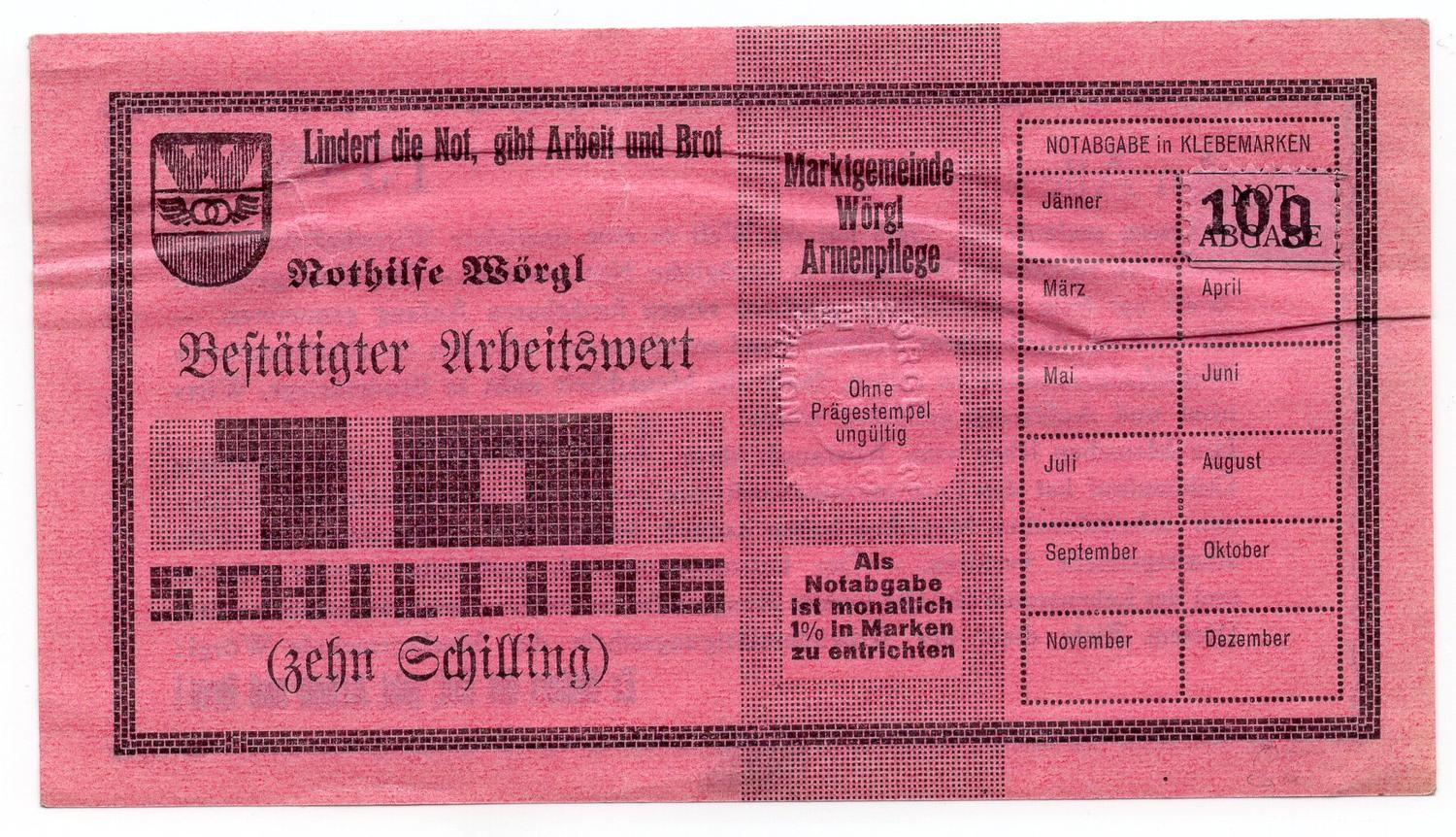

Woergl’s currency is called Bestätigter Arbeitswerte or Labor Certificates. The new coin’s denominations correspond to the value of 1, 5 and 10 shillings, and the special feature is that they lose 1% of their value every month, meaning that in one year they could depreciate 12%. A currency with already programmed inflation, in short.

The people in Woergl thus find themselves with two currencies: the official Austrian schilling and Unterguggenberger’s labor certificates.

The operation is financially covered by the 32,000 shillings in the municipal coffers, lodged at the local bank.

# Half wage in shillings and half in Bestätigter Arbeitswerte

Municipal employees, including the Burgomaster, begin to receive their salaries divided in half between two different currencies, one of which is destined to lose value. At the same time some of the unemployed are hired, paid entirely with this currency.

The depreciating currency begins to be spent very fast, because no one has any interest in keeping something that depreciates quickly. Since it is totally covered by the deposit of true shillings, anyone can go to the bank and have their Labor Certificates exchanged for Austrian currency, agreeing to lose 5% of the counter value withdrawn.

Municipality and bank gain numerous benefits, such as recovering thousands of shillings in outstanding taxes and substantial bank deposits.

The citizens, forced to accept these conditions,, immediately put into action a milestone of the Austrian school of economics: the more depreciating a currency is, the more you put it into circulation.

# The performance of the small municipality

In this way, the Burgomaster creates the conditions to get the economy rolling again. In less than two years, a municipality on the edge of financial collapse manages to pave several roads, build a bridge over the Inn River, and employ many of the 1,500 unemployed counted in 1931. The achievements convince approx. 200 municipalities in the region to demand to adopt the same system. Even from France comes Minister Édouard Dalladier to study the phenomenon.

Burgomaster Michael Unterguggenberger, along with a delegation from Woergl, is received by Rintelen, a member of the Austrian government to show the results of his two-year experiment. It looks like a success in every way you look into it, and the beginning of a new era. However, as is often the case, power does not like what makes individual territories and citizens freer.

# From model to issue (for whom?)

Woergl’s test welcomed amid general surprise and hilarity, after its successes triggered increasingly violent criticism, including allegations that it was a scam. Yet in a short time it showed that a “free currency” from the constraints of state financial policy, could engender progress.

In the two years that the Labor Certificates were in circulation, only the state-linked Austrian Post Office and railways refused to accept them as payment.

But the phenomenon had by then made the rounds of the players who mattered; even economists and academics began to take it in serious considerations.

Does it seem all set for a happy ending? But no. The devil was ready to step in. From a model of economic recovery, Woergl’s currency became more and more of a problem. For whom? It is easy to imagine, comparing to what is happening in our days: the central bank.

In fact, a decisive reaction from the Austrian Central Bank came in, which, seeing its monopoly in the production of currency threatened, accused the town of “exceeding its powers“, since “the privilege of printing currency belongs only to the Central Bank“, The new currency was declared illegal and the experiment of a “free currency” closed definitely on September 15, 1933, by government executive decree.

Michael Unterguggenberger’s attempt to appeal, which was rejected by the Supreme Court.

The only reason for that decision was that it challenged the central bank’s monopoly role. No other reason in the face of the many successes for citizens, workers and the economy as a whole.

At a time of a currency crisis and centralized control of the money market such as the present, many are calling for the need to create parallel monetary forms to give the economy more breath.

Two lessons can be learned from Austria’s experience in the early 1930s. The first is that a local, uncoupled currency, with its own manifest decay, could solve many of the problems we are experiencing. The second is that political power would immediately get in the way: the FED/BCE and the institutions that share its power. As long as the logic of power in a few hands prevails over the good of the people, the destiny can only be the same as Woergl’s currency. Hoping that the next scenario will be less tragic than a new global conflict

Continue reading: The lack of money is the engine of history

LAURA LIONTI