The earthquake seems to start.

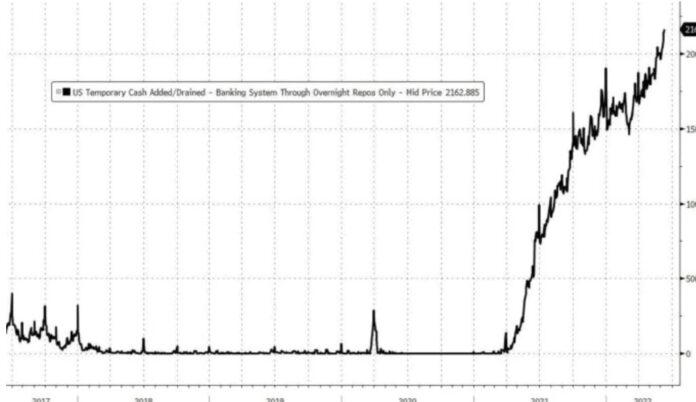

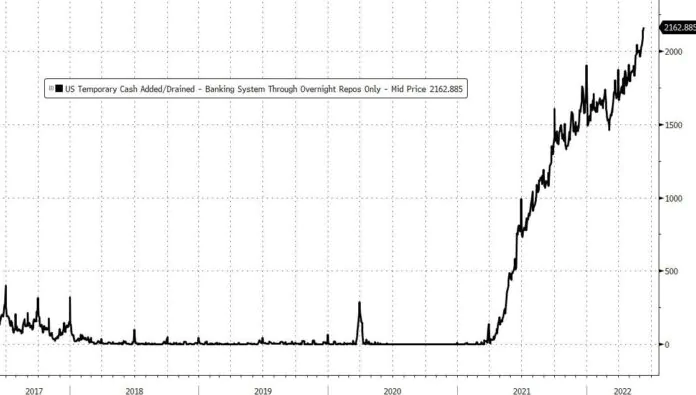

A highly observed place for traders is the Fed’s Reverse Repo, which is where the overnight money, so called “the shorter money”, and liquidity of large financial groups is parked.

Recently there have been a series of unprecedented records: the money parked overnight has reached two trillion a day, a stratospheric figure compared to the past. There are two opposite different explanations among the leading experts.

The mainstream commentators think that this depends on the fact that the system is full of liquidity: you park the money to take a risk-free interest, without using it in any other way.

The other assumption is terrifying: the huge amount of money parked means that, much like what happened in 2008, the primary money dealers have less and less confidence in the counterparty.

The collateral that was traditionally accepted to secure these transactions, which are usually US Treasury bills, is being used less and less.

The fact that all this money is not being used, means that the counterpart risk is increasing dramatically, which is one of the most serious signals of fragility in the financial market which is based in particular on the trust in solvency between the different operators.

According to these analysts we are approaching an inevitably systemic collapse, which will lead to a crack chain like the one of Lehmann Brothers. This interpretation is on top of more obvious data, such as the boom in commodity prices or as the index of consumer’s confidence in the United States that has reached its lowest level ever.

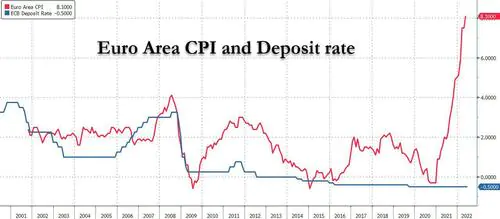

The situation in Europe is even worse. One of the most followed web sites in the American financial world, “Zero Hedge”, for days has emphasized the gravity of what is happening in the Old Continent where, in a situation of 8% inflation, every possible Central Bank manoeuvre in support of the eurozone’s economies and debts is failing.

The previous crises, those that led to the “whatever it takes”, to the ECB’s manoeuvres to purchase national debt securities, had very low inflation across Europe. But in this case, with inflation at its highest level since the 1980s, from one side the expansionary policies can increase the inflation even more, on the other hand there is a rupture in the “sentiment” between countries of Northern and Southern Europe, with the first who want to take measures to protect savings from the bites of inflation, even by putting at risk the state budgets of the most indebted countries in southern Europe.

So, it seems there are all the signals for a system collapse. Italy is likely to be the weakest link in the chain and could be the starting point of this huge storm, as among other things this is occurring these days with the biggest drops that are hitting Italian banks, the listed stock list in Milan and the soaring rates on national government bonds.

Is the moment of panic coming, then? In reality there is also a more optimistic view in the alternative version of the mainstream.

The fact that the economy is considered as the closest logic to the one of nature: As the creative force of nature cannot be suppressed for too long, so it will be for the economy. Any drop or collapse, no matter how terrible it may happen, can only be the point of access to a new phase of creation of value and wealth. Probably the less artificial and healthier creation than in the last decades.

LAURA MALTAGLIATI

(Original article by La Fenice)